Financial Information

We are committed to maintaining a healthy organizational climate with the highest ethical standards. As part of that commitment, we disclose summary financial statements as well as maintain a GuideStar non-profit profile:

Our fiscal year runs from 1 Jan to 31 Dec.

CY 2021 Financial Information

In CY21 Revere’s Riders had gross revenue of $46.9K and expenses of $36K producing an operating surplus of just over $10.9K. The year ended with net assets of just under $44.9K.

2021 Final Statement of Activity

2021 Final Statement of Financial Position

CY 2020 Financial Information

In CY20 Revere’s Riders had gross revenue of $44K and expenses of $23.2K producing an operating surplus of just over $21K. The year ended with net assets of just over $42.6K.

2020 Final Statement of Activity

2020 Final Statement of Financial Position

CY 2019 Financial Information

Below please find our CY19 financial information.

In CY19 Revere’s Riders had gross revenue of $35.5K, expenses of $25.7K, and an operating surplus of just under $10K. We ended the year with reserves of $21K. These reserves represent just under one year’s operating expenses at our current operations tempo which we feel is reasonable and prudent.

2019 Final Statement of Activity

2019 Final Statement of Financial Position

CY 2018 Financial Information

We are proud to share our 2018 preliminary financial figures in the interest of transparency and accountability. The detailed reports are linked below. In summary, for 2018, Revere’s Riders had net revenues of $13.6K and expenses of $12.2K, with modest net revenues of $1.4K. We anticipate expending much of this surplus in early 2020 due to insurance costs as well as expenses associated with the NRA Annual Meeting.

We are currently maintaining a prudent operating reserve of $11.6K. This represents about one year’s operating expense.

2018 Statement of Financial Position

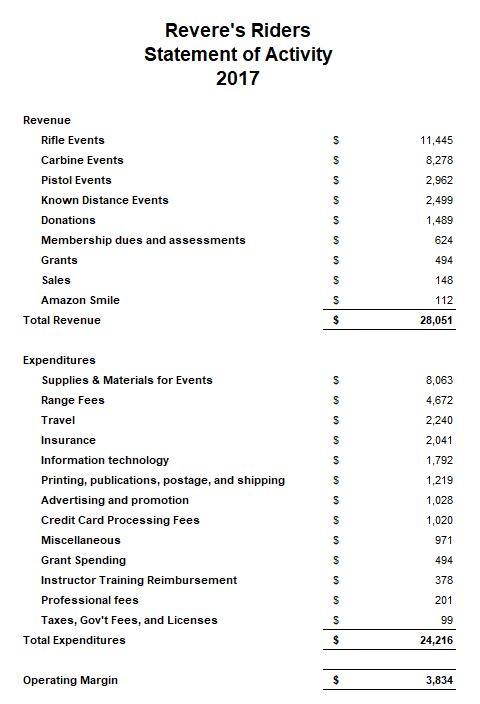

CY 2017 Financial Information

As a small non-profit grossing less than $50K, we will be eligible to file Form 990-N. However, in the interest of transparency, we are also releasing our financial records. Each line item on the financial statement corresponds to the line numbers for a full Form 990 used by larger non-profits.

As you can see we largely ran on a “break even” basis with a small ~$4K surplus at the end of the year. A significant percentage of that surplus was allocated during 1Q2018 for events as we gear up for our busier spring and summer season.

Our cost for supplies and materials increased with the number of shooters that we had in 2016. In 2016 we had 279 students ($15/shooter) vs. 435 in 2017 ($18/shooter). The cost per shooter increased slightly as we ran more advanced events requiring more equipment (such as steel, larger targets, dummy rounds, radios for pits, etc) such as known distance and carbine in 2017.

Our range fees also increased significantly. We increased the number of events nationwide and also had more events at ranges that charge for attendance such as the Clark County Shooting Complex and Camp Atterbury. No board member has any financial interest in any of the range facilities that we use.

Running events in more states and with more advanced instructor requirements also drove more travel expenses in 2017.

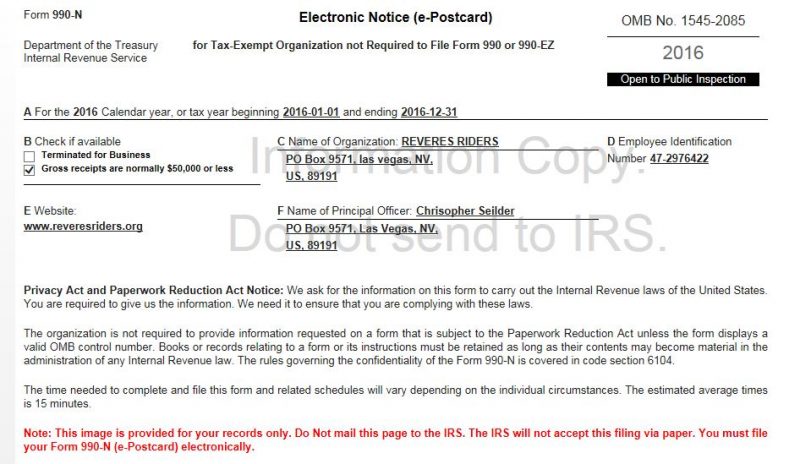

CY 2016 Financial Information

As a small non-profit grossing less than $50K, we were eligible to file Form 990-N (which is included below). However, in the interest of transparency, we are also releasing our financial records. Each number on the financial statement below corresponds to the line numbers for a full Form 990 used by larger non-profits.

Click here to download our full 2016 financial statement — the major items are summarized below: RR Statement of Accounts Financials 2016

- Revenues $15,748.69

- Contributions, gifts, and grants: $1092.58

- Program service revenue: $14,132.87

- Membership, other and sales: $523

- Expenses: $10,203.96

- Supplies & Materials for Events: $4173.57

- Insurance: $1849.53

- Apparel: $575.93

- Range Fees: $572.00

- Advertising and Promotions: $558.98

- Taxes, Gov’t Fees and Licenses: $550.00

- IT: $470.60

- Credit Card Fees: $373.01

- These were our major expenses — please review PDF for all other expenses breakout

- Net Revenue: $5,544.73

As you can see, our expenses remain low. Typical event fees charged by our non-profit are about 1/3 those charged by commercial for-profit instructors offering similar classes for adults; children receive an additional 50% discount. Our largest expenses for CY2016 remain supplies for events and insurance.

These expenses supported about three hundred full one- or two-day class students as well as Revere’s Riders support for nearly four hundred youth at NRA and Boy Scouts events at 43 clinics.

In 2016 we ran a moderate surplus of around $5K. We intend to earmark some of these funds as a one year operating reserve, and most of the remainder of this surplus has already been allocated to upcoming 2017 expenses.

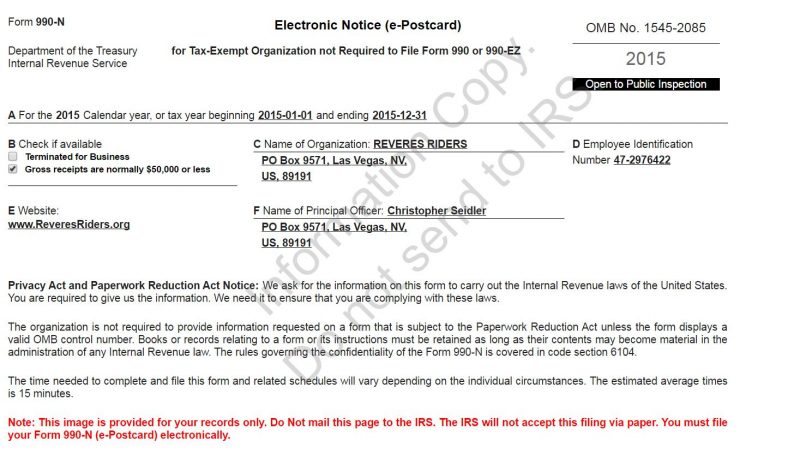

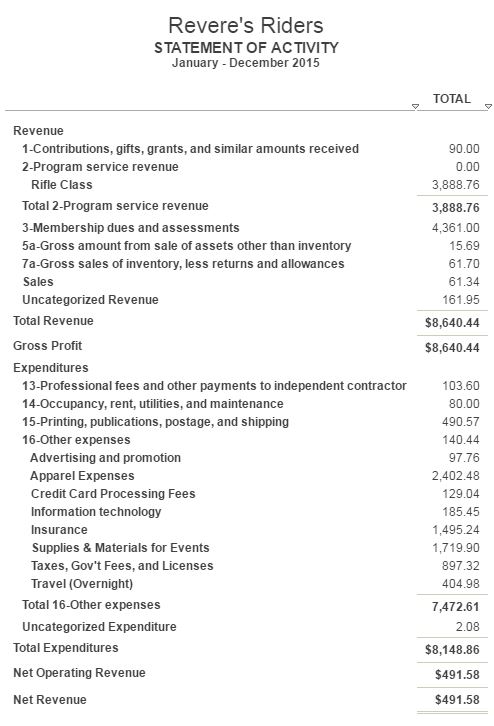

CY 2015 Financial Information

As a small non-profit grossing less than $50K, we were eligible to file Form 990-N (which is included below). However, in the interest of transparency, we are also releasing our financial records. Each number on the financial statement below corresponds to the line numbers for a full Form 990 used by larger non-profits.

As you can see, our costs are very low. Typical event fees charged by our non-profit are about 1/3 those charged by commercial for-profit instructors offering similar classes for adults; children receive an additional 50% discount. Our largest expenses for CY2015 were apparel, supplies for events, insurance, and taxes/fees/licenses. Some of the details of the more notable expenses are broken out below. We are committed to ensuring our members, students, sponsors, and donors can see how their funds are being responsibly expended.

- Apparel: Each volunteer received a t-shirt and baseball hat so that we can present a uniform presence to the public. In addition, attendees receive baseball hats and patches as certificates of achievement. Many of these expenses were one-time expenses in 2015 due to large bulk orders to lower per-unit costs and setup fees.

- Supplies for Events: Each event requires supplies such as targets, safety equipment, historical materials, and so on.

- Insurance: Our insurance coverage is in line with standard coverage maintained by NRA-affiliated clubs.

- Taxes, Fees, and Licenses: 2015’s expenses in this category were unusually high due to a one-time IRS Non-Profit registration fee. However, we do expect to have continued compliance costs associated with state and local requirements. While non-profits often receive a discounted rate, these fees are unavoidable.

- Travel (Overnight): These costs were associated with supporting the NRA Annual Meeting’s Youth Day. Volunteers carpooled and shared hotel rooms in order to support the kids as volunteers for the the NRA Annual Meeting.